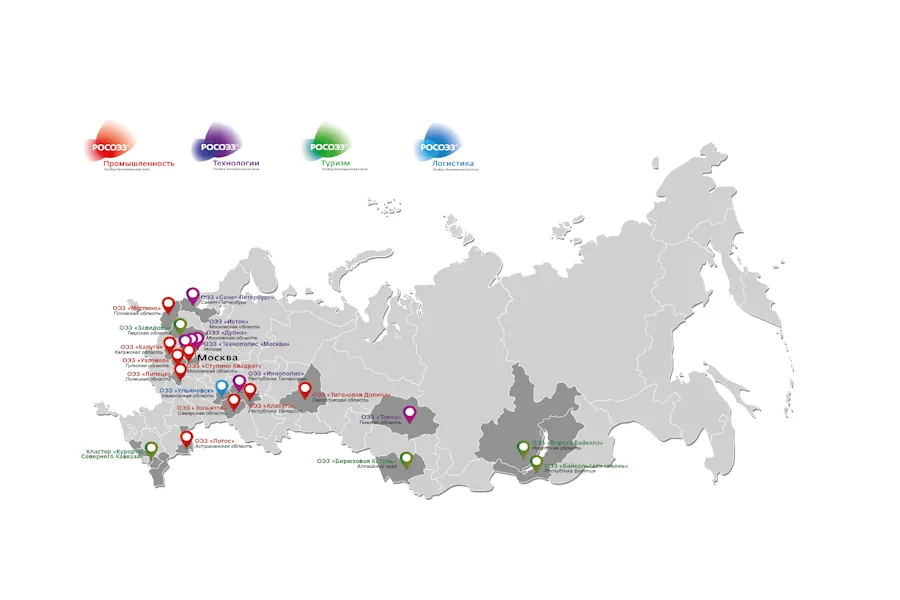

Russia has implemented an extensive project to attract direct investments into priority sectors of the economy — Special Economic Zones (SEZ). Over 18 years of experimentation, 50 SEZs have been created, generating 66,000 jobs. A total of 1,128 residents, including those with foreign capital from 36 countries, have been registered. The volume of investments exceeded 990 billion rubles. Impressive statistics result from a preferential business environment.

What are SEZs?

A Special Economic Zone is a part of the territory in a specific region that is subject to special state regulation, free customs zone, and preferential regimes for entrepreneurial activities. This is a development strategy for depressed, border, and coastal areas.

SEZs are created by the Russian government for a term of 49 years. The highest executive authority of a Russian Federation subject submits the application. The procedure is regulated by Federal Law No. 116 of July 22, 2005.

Types of Special Economic Zones:

- Port;

- Technoparks;

- Tourist-recreational;

- Industrial-production.

Each SEZ site has modern, new infrastructure and operates in conditions of innovative developments. To enhance investment attractiveness, organizers establish business incubators, build roads, provide utilities, high-speed internet — in other words, create a ready-made ecosystem.

Project goals include producing new goods, developing high-tech industries, tourism, health resorts, infrastructure facilities, and developing and commercializing technologies. SEZ residents are not allowed to have offices or branches outside these zones.

Industrial-production SEZs

In Russia, this type of SEZ is the most numerous. As of 2023, contributions to the country’s budget exceeded 191 billion rubles. Among the 31 sites with 367 registered companies, there is a well-known zone ‘Alabuga’ in the Republic of Tatarstan, as well as ‘Stupino Square,’ ‘Togliatti,’ ‘Titan Valley,’ ‘Orel,’ and ‘Grozny.’

Activities include:

- Production and processing of goods;

- Sale of goods in areas of no more than 40 sq. km;

- Technological and innovation activities.

SEZs of this type are located in the most developed regions where industrial enterprises prevail, with well-developed transportation hubs, a qualified workforce, and rich natural resources. Residential facilities are prohibited in such SEZs.

Conditions for residents: only commercial organizations (except unitary enterprises); the size of capital investment is 120 million rubles, with one-third to be invested in the first 3 years. Losing resident status allows continuing activities in the SEZ.

Port Special Economic Zones (SEZs)

In Russia, there are operational SEZs such as “Ulyanovsk” and “Olya,” with 51 companies already becoming residents. As of 2023, tax and customs payments to state extrabudgetary funds exceeded 1.9 billion rubles.

Work vectors include:

- Ship repair and shipbuilding activities

- Logistic services

- New routes near major transportation pathways

- Port activities

- Reconstruction, construction, and operation of marine, river, airport infrastructure objects.

SEZs are established on areas of no more than 50 square kilometers. The investment capital is 400 million rubles for infrastructure construction and 120 million rubles for reconstruction, provided 40 million rubles are invested in the first 3 years.

Customs zone procedures are always applied to the areas, but the construction of residential facilities is prohibited. Only commercial organizations, excluding unitary enterprises, can be residents. Investors in other statuses do not engage in activities in such SEZs.

Tourist and Recreation SEZs

Tourist and recreation-type economic zones are created for the development and provision of services in the tourism sector in one or several areas of the country. Currently, there are 10 TRT SEZs with 111 registered companies and nearly 900 thousand jobs created, including “Arkhyz,” “Baikal Harbor,” “Elbrus,” and “Zavidovo.” The budget has received 0.2 billion rubles in taxes.

Features of TRT SEZs:

- The procedure of a free customs zone is not applied.

- Construction, reconstruction, and operation of residential property, tourist industry, recreation, sports activities, medical rehabilitation, and sanatorium treatment objects are allowed.

- Industrial bottling of mineral waters.

Conditions for participation include residents and non-residents, including those who have lost their status, individual entrepreneurs, and commercial organizations (except unitary enterprises).

Technopreneurial SEZs

In Russia, there are 7 TVT SEZs: “Innopolis,” “Dubna,” “St. Petersburg,” “Technopolis Moscow,” “Istok,” “Tomsk,” and a zone in the Saratov region. Revenue for the first half of 2023 exceeded 1,029 billion rubles, with tax and contribution payments totaling 186 billion rubles.

Goals of activity include:

- Innovative development

- Creation of scientific and technical products

- Implementation and industrial application of new developments

- Manufacturing of experimental batches

- Creation of assembly systems, software products, their implementation, and maintenance

- Industrial production

- Research institutions

Investors can be residents and non-residents, commercial enterprises (except unitary enterprises), and individual entrepreneurs. In this segment, 516 companies are already registered, and 34 thousand jobs have been created.

Business Advantages

SEZs operate in a narrow focus and aim to develop specific segments, so privileges depend on the type of SEZ and are complemented by specific platform conditions.

Privileges and preferences for residents of special economic zones include:

- Favorable conditions for leasing and purchasing land plots. For example, in TVT “Dubna,” land can be leased for 1% of the cadastral value per year, or real estate can be purchased on 15% terms. For projects like TRK “Arkhyz,” during long-term land lease and purchase, there is a zero land tax rate for the first 5 years.

- Tax incentives. Investors are offered minimal or zero interest rates on key taxes. For instance, in TRT SEZ “Baikal Harbor,” residents do not pay transport tax and property tax for the first 5 and 10 years, respectively. The corporate income tax rate is 15.5%, while the average rate in the Russian Federation is 20%. Tax holidays start from the moment the tax base appears. Preferential rates apply to the calculation of insurance contributions for employees.

- Customs preferences. Many investment platforms operate under a free customs zone regime. For example, SEZ “Alabuga” provides customs benefits in the form of 0% VAT and import duties. Conditions are created for the quick passage of customs procedures through modern equipment.

- Accessible communications. Optimal information and communication infrastructure and high-quality engineering and technical support are provided. Project participants are offered free connection to engineering infrastructure and communications, favorable rates for energy resources, services for the transmission and transportation of thermal energy, water, and wastewater.

- High human potential. The prospects of regions where SEZs are created attract the scientific potential of the country. Staff work is optimized. SEZs offer decent internship and implementation conditions. Projects attract with their prestige, eliminating a labor shortage.

- Modern, innovative infrastructure. For example, global transit corridors are located in close proximity to SEZs. Convenient logistics is ensured. Comfortable and reliable routes are developed. SEZ “Technopolis Moscow” offers residents ready congress and exhibition areas. In the SEZ in the Saratov region, a business incubator has been built, a technopark is functioning, and research conditions have been created based on the university.

Innovation Project Support

A distinctive feature of special economic zones is the mutual interest in project development from the state, investors, and business representatives. This leads to the minimization of administrative barriers.

Organizers provide assistance in the initial stages of implementing innovative projects, ensuring comprehensive support throughout the entire implementation process.

A characteristic feature is the prompt decision-making at all stages. From the moment a potential resident submits an application for registration to the approval of the final decision by the Expert Council and the signing of a cooperation agreement, it takes 40-60 days.

The document workflow process is maximally simplified. Specialists provide consultations on the action algorithm, presenting projects in an accessible way. Each SEZ platform has an official website with a user-friendly interface and comprehensive information.

Conclusion

Special Economic Zones are part of the nationwide strategy for the country’s economic development and business support. Their number and scale increase as part of the optimization of domestic policies. For example, since July 2023, another SEZ has been operational in new territories of the Russian Federation under the management of the Ministry of Construction.

The legal status of an SEZ resident provides competitive advantages in business and allows for extensive tax, customs, and social preferences. The main advantage of conducting business in such a format is reflected in statistics: when implementing projects in special economic zones, investor costs are reduced by an average of 30%

Разрабатываем Стратегии для собственников бизнеса в целях оптимизации группы компаний, решения нестандартных задач и продажи активов. Оказываем услуги по сопровождению сделок M&A, управлению непрофильными активами и проектами в целом.